Early Stage Growth Funds for Startups

9 years ago Shalini BHighlights of Early Stage Growth Funds for Startups – Virtual Q & A

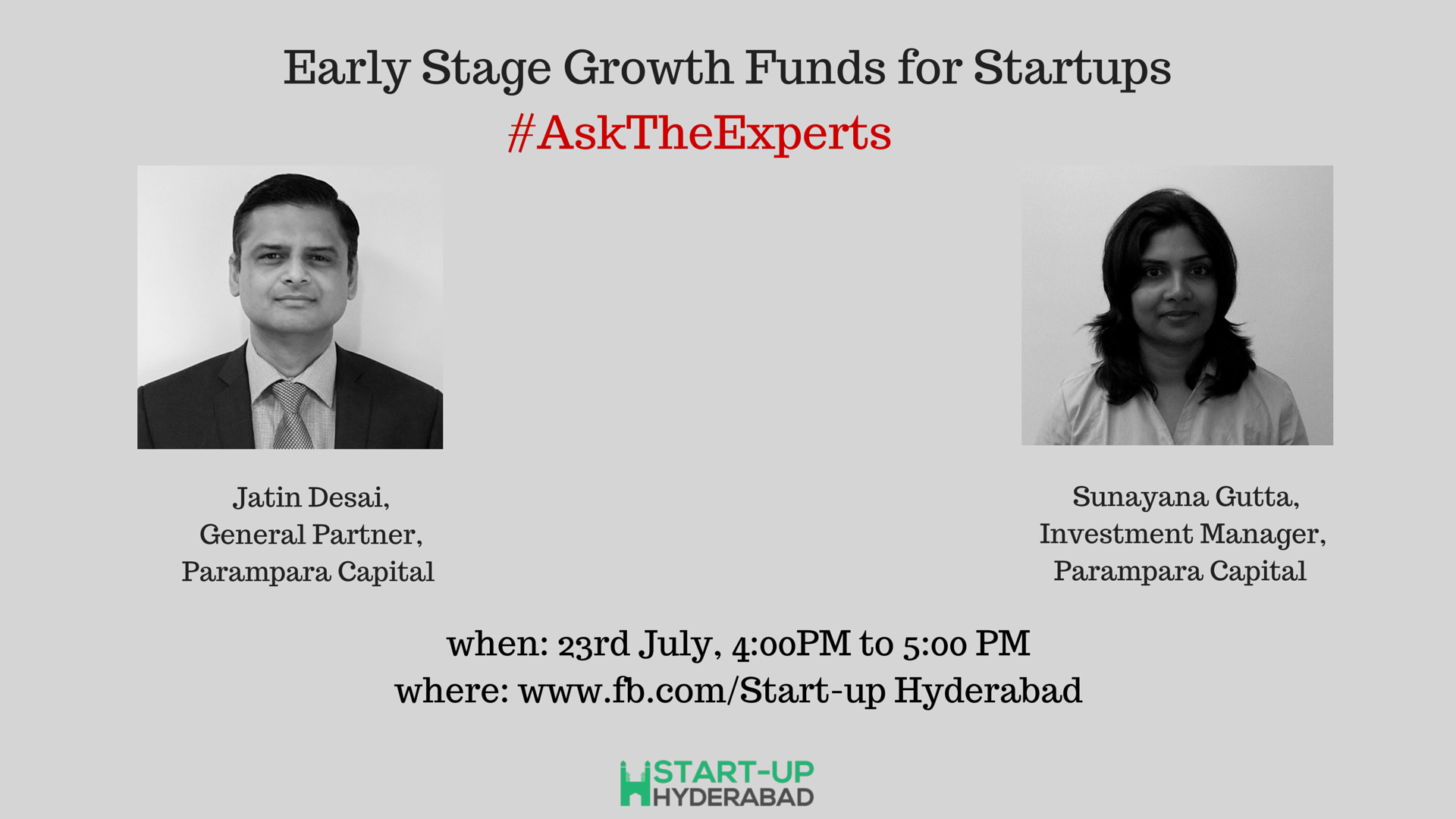

Every month Startup Hyderabad organizes a virtual Q & A session on Facebook and brings in experts to answer queries. This time the theme for the session was “Early stage growth funds for startups†and we had experts from Parampara Capital to help readers understand the process of early stage funding.

Jatin Desai and Sunanya Gutta, experts from Parampara Capital took the initiative to patiently answer all queries of the guests participating in this session. The virtual Q&A happened on July 23rd 2015, and approximately 75 guests participated in it.

Jatin Desai is a general partner of Parampara Capital and has over two decades of global familiarity in technology delivering solutions for Wall Street banks, Fortune 500 companies, and SMEs/startup ventures in the US. His most recent experience was as CIO of Bank of America Merrill Lynch in India and as CTO for DSP Merrill Lynch in India for 6 years and as Head of Global Markets Technology and Global Risk and Treasury Technology for Bank of America’s captive in India for 2 years prior to that. In his CIO role – Jatin was also part of Country Leadership Team of Bank of America Merrill Lynch in India which had oversight all of the firm’s business and operations locally and also member of LMT-Local Management Team of Bank of America in India (equivalent of the Board of the bank’s foreign branch in India from local regulatory perspective).

Sunanya Gutta is the investment manager of the same firm. She is a Chartered Financial Analyst (CFA) and an MBA (Finance). A gold medalist in her MBA program, she has 8 years of experience in the financial services industry especially investment banking and private banking. A passionate financial analyst, she has good understanding of industries, sectors and economy. She plays a key role in research as well as in identifying and evaluating investment opportunities. She has worked with UBS (Investment Banking Division) and Anand Rathi Private Banking in the past.ÂÂÂ

Here is a quick overview of the questions asked and the answers that came along from the professionals –

Q. As an investor, what all the things you would like to have in the investor pitch documents whenever a startup approaches you for funding?

A: Apart from the details on the firm’s business model, we look to see information on team profile, the competitive landscape and the current and future business plans. A good pitch usually also gives information on where the funds would be used.

Q. How do you assign a value to a start up?

A. That’s a subjective topic & it really depends on the stage at which the start up has come to the investors for funding. Some of the traditional methods like PE multiple, DCF method etc may not work for most of the startups so what we apply generally is the VC method or Dave Berkus method based on strength of team, idea, current state & future scope/plans.

Q. Is there a right time to seek VC funding for a start up?

A. Typically – most first time start up founders bootstrap (self-fund), then go to angel funding for the next round followed by VC, PE, exit/IPO sequence but you can always skip some steps depending on the profile, ideas, traction etc at various stages in the lifecycle.

Q. Why is it Investors generalize a notion of person leaving the job for the Passion for the startup? It can be any subjective decision for that team or person rather than being tagged as safe player, as raising the fund is 6 months exercise.

A. Jatin Desai shared his opinion as below

“I don’t believe that is the case with us at least & quite a few others that I know (if I have understood your question correctly). We have invested in companies with varied pre-founding history of the promotersâ€ÂÂ.

A woman entrepreneur who already owns a startup, enquired about how well her startup is doing in the following way –

Q. I have an early stage start-up with three technologies transferred from my University for new drug discovery for breast cancer and neuropathic pain. Please guide me how attractive is for VC funding.

A. Sunanya Gutta found this an attractive idea and said, “The stage of product development, the projected market size and status of regulatory approvals would be the key factors in evaluating the opportunityâ€ÂÂ.

Q. People say you should be focused on one idea as an entrepreneur. How much of that is considered by Angels and VCs when they make funding decisions? How far will it justify the title ‘Serial Entrepreneur?’

A. Focus on one idea as an entrepreneur is more about focus at a given time I opine. It is important for the investors as well that the founder focuses on one idea at a time.

Q. It is a common notion that ideas sent to angels and VCs through e-mail are rarely shortlisted for an in-person round. What’s Parampara’s take on this?

A. Yes. That is a common notion and many funding companies are very candid in mentioning the same on their websites. However, at Parampara, we screen every opportunity that we come across and a Partner at Parampara has to back the same to forward it to the Investment Committee for further discussions.

Q. As per the VC method or Dave Berkus method valuation of a startup, based on future projections or existing investment. Which one is more important?

A. The future projections are very important. While the VC Method relies quite a bit on the future projections, the Dave Berkus method involves a lot of evaluation on mostly non-financial parameters.

Q. A guest asked, “We have developed a product and iterated over it multiple times and were very succesful in doing so. But our product never took off the ground, since we lacked necessary impetus and financial push to get in to the market. How we do we get through this scenario and get to the next level? Are there any steps that we can follow for success? What is needed to take from A to B?â€ÂÂ

A. The funding is usually in stages where most companies move from wither bootstrapping / procuring seed fund from friends and family. The next stage would be as mentioned by Jatin to approach incubators / angel networks.

A huge thanks to Jatin Desai, Sunayana Gutta and the entire Parampara Team for taking time out of their busy schedules to be a part of our initiative to support startups. Growth stage startups seeking investments can get in touch with them at ideas@paramparas.com .

Keep following us and do write to us if there is any topic/ feature that you would like us to write about or incorporate in our Q & A sessions. Suggestions welcomed .