Lessons every entrepreneur should learn from Masayoshi Son

8 years ago Guest - Manideep Dyavanapalli, Student Startup EnthusiastMasayoshi Son, currently Japan’s second wealthiest man has been inspiring everyone with his strategies ever since the dot com crash. His company Softbank, Japanese Multinational Telecommunications and Internet Corporation has operations in Broadband, Fixed-line Telecommunications, E-commerce, Internet, Technology services, Finance, Media and Marketing, and other businesses. Son recently stepped down as the president of SoftBank and appointed Indian born Nikesh Arora(47) as the president and chief operating officer paying him a jaw dropping salary of JPY 16.5 billion (USD 135 million). His salary stands Rs.120 crore per month or Rs.4 crore a day. Son is presently world’s 75th billionaire with a personal wealth of $13.3 billion according to Forbes (as of August 2015).

Start early: Son made his first money out of his pocket when he moved to California and started several businesses at the age of 16 and used his technical skills to invent and patent a device which he sold to SHARP later at the age of 20 for $1 million. Son used to think in an entrepreneual way since his childhood. He used to think of at least one entrepreneurial idea a day. He started his company Softbank at an age 23 though which is not too young to start with, but with the economic and political conditions in Japan during that time it was indeed a brave act. Apart from Japan, Softbank today has its operations in the United States and Korea. Sprint Nextel Corporation is considered to be one of the greatest acquisitions by Son for $21.6 billion which holds about 78% stake in the company. SoftBank is also a key investor in major Indian companies like Ola, Snapdeal and Housing.com.

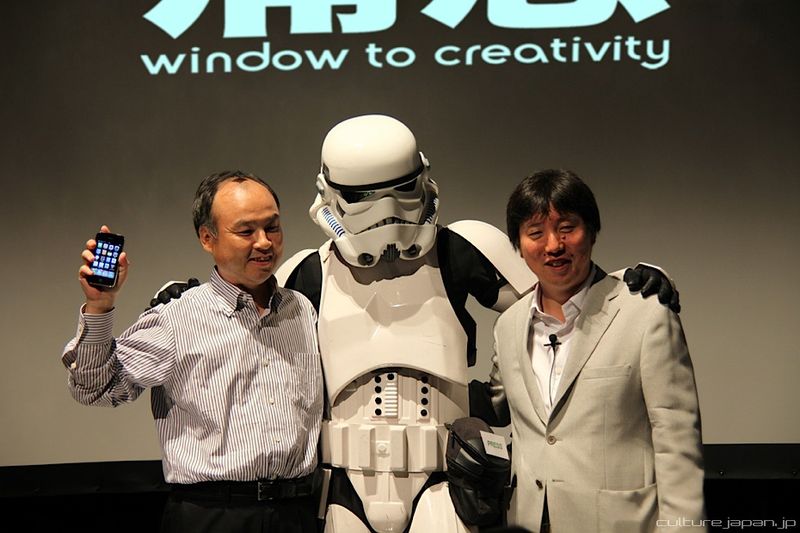

Have big friends: Masayoshi son has many of the revolutionary friends which include Jack Ma and Steve jobs. Being a good investor, Son is a longtime friend and partner of Jack Ma, founder of Chinese e-commerce website Alibaba. Son is presently the largest stakeholder. Alibaba’s record-setting IPO last year made Son the richest in Japan. When iPhone was introduced into the world Son solely had rights to market it in Japan. This is because Son is a close friend to Steve jobs. When Son met jobs for the first time he gave his idea to turn iPod into an iPhone. Jobs was impressed by his idea and both became good friends after that and gave him the right to sell the phone exclusively in Japan. This move made iPhone top-selling devices in Japan and a study said that more than half of the competitor DoCoMo’s customers had switched to a network that sells iPhone.

I’m a human. So, I want to be number one: Masayoshi Son once quoted this as an answer to the reporter which impressed everyone. Son is truly number one when it comes to investing. Son’s company Softbank has been a key investor in most of the leading companies such as Zynga, Yahoo!, Huffington post, Snapdeal, Alibaba, housing.com and many more. He also started Yahoo! broadband in September 2001 with Yahoo! japan. He predicts India and China would be the leading competitors in the next 25 years and hence the eyes Indian companies. Son also has a good hand in philanthropy like most of the other billionaires. He donated 10 billion Yen after the earthquake and tsunami that hit Japan in 2001. He also owns pepper, a humanoid robot and only one such company to exist.

Best of all- Never give up: Have you heard of the dot-com crash and how much did Masayoshi son lost due to that? Son lost a jaw-dropping 70$ billion due to the crash. He also noted that he was richer than Bill gates for 3 days before the dot-com crash. Just before the crash, Son announced his intention to pay $15 billion USD in cash for Vodafone Japan, in order to compete with the government-owned NTT DoCoMo network. The market responded negatively and Softbank stock deteriorated. Then the dot com bubble crashed. Softbank lost 99% of its market cap (it went from $200 billion to $2 billion) and operated at a $1 billion annual loss for several years.

.