Releasing its quarterly earnings, Zomato (previously FoodieBay) reported its first-ever quarterly profit.

Way ahead of schedule (as stated in their previous quarter for profitability to take another year) Zomato’s Rs. 2 crore profit after tax (PAT) is a milestone investors are ecstatic over. Zomato Chief Financial Officer Akshant Goyal stated on the company”s earnings call that the company would continue to deliver 40% revenue growth year-on-year for at least the next two years.

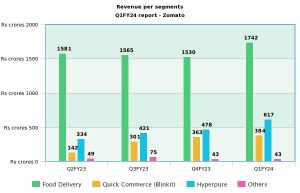

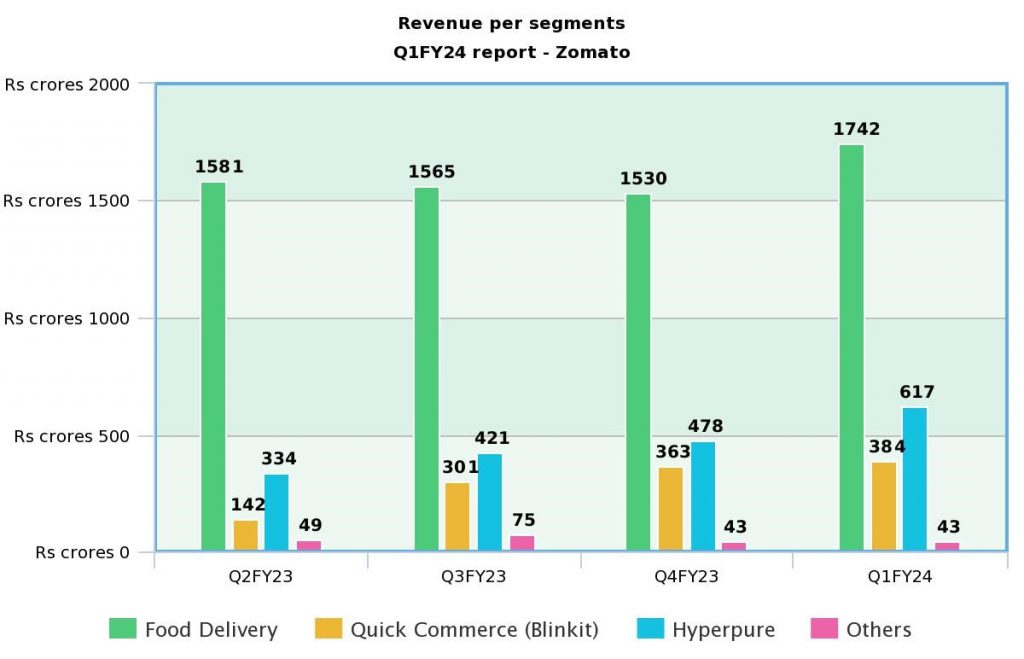

Already representing 70% of the Year-on-Year growth, Zomato’s revenue in the quarter ended June 2023, stood at Rs. 2416 crore as against Rs 1,414 crore reported by the company in the corresponding quarter of the last financial year. In its report, founder, Deepinder Goyal, and CFO, Akshant Goyal discuss the driving forces behind their growth. Here is how Zomato reached its milestone early.

1. Growing adoption of Zomato’s Gold Program

Zomato’s core food delivery business saw revenues of Rs 1,312 crore in the quarter ended June 2023. Attributing this growth to the uptick in demand and the growing adoption of our Gold program, Zomato reports an 11% jump in its gross order value (GOV)-the cumulative value of all food delivery orders placed on the platform.

Contributing nearly a third of Zomato”s GOV for the quarter, Zomato’s loyalty Gold program singlehandedly drove the frequency of orders, touching Rs 7,318 crore, as stated in the reports.

2. Hyperpure in its growth arc

Another major contributor to Zomato”s growth was its farm-to-fork inventory and kitchen supplies business Hyperpure. Having acquired this vertical in 2018, Hyperpure has begun to hold its weight with revenues growing 126% year-on-year (29% quarter-on-quarter) to Rs 617 crore in the quarter ended June 2023.

According to Zomato’s management, this growth primarily resulted from increasing the minimum order value threshold and utilizing Hyperpure”s supply chain for quick commerce business via Blinkit. Additionally, in explaining this move, the management claimed that the increase in the minimum order value significantly drove the average order value, resulting in both growth in revenue and improvement in profitability.

Moreover, according to an analyst report by brokerage Motilal Oswal, the Hyperpure segment will see a compounded annual growth rate (CAGR) of 36% between the years ended March 2023 and March 2025. With Hyperpure’s margins improving significantly-from -16% to -4.7%, year-on-year, Motilal Oswal predicts Hyperpure will break even well before Zomato”s target of March 2024.

3. Blinkit’s muted growth, a light at the end of the tunnel?

Zomato”s quick-commerce business, Blinkit saw a slower sequential GOV growth in Q1FY24 recording 36.8 million orders compared to 39.2 million orders in the previous quarter. Additionally, recording a slowdown in its GOV, Blinkit’s GOV grew a mere 5.5% quarter-on-quarter as compared to 16% in the previous quarter.

Cofounder and CEO of Blinkit, Albinder Dhindsa attributed this slump to a temporary business disruption faced due to a change in the delivery partner payout structure. However, he maintained that the object of the payout changes wasn”t cost savings but rather to make sure that our entire delivery fleet was on the fairest and equitable payout structure.

Moreover, the report has stated that the company has experienced healthy growth since June, and expects the growth rate to recover and grow more than 20% in the next quarter.

4. Innovate & Expand – A fourth engine

In an attempt to merge and scale their dining out + live events, Zomato is gearing up to launch a new app, Going Out. With their already successful live event vertical, Zomaland, which hosts events such as music and food festivals, Going Out will be the perfect culmination of the events and ticketing experience (Zomato Live), and the dining-out feature.

Next quarter onwards, we are going to report Going Out as a separate business segment in our financials. We are also contemplating spinning out our Going-out business into a separate app, in line with our so-far-successful strategy of building super brands (and not super apps), the company said in its report.

See how innovation is driving other segments:MediaMint Secures Strategic Growth Investment From Everstone Capital and Recognize

Expecting this business to be the fourth largest in its portfolio, Zomato is gearing up to hire software developers, designers, and social media team to handle the app’s portfolio for Delhi, Mumbai, and Bengaluru.

Zomato’s NetZero mission

With global warming much more adverse than ever, Zomato’s goal to achieve Net Zero emissions across Zomato”s food delivery value chain in the next 10 years i.e., by 2033 is a step towards sustainability. Up until now, Zomato was neutralizing its emissions through the purchase of carbon credits. However, with the NetZero target, they aim to focus on reducing their emissions, while limiting their purchase of carbon credits.

Q1 results push share value- Should you buy?

With a consolidated net profit of Rs 2 crore for the quarter ended June 2023 against a loss of Rs 186 crore in the corresponding quarter of the last financial year; Zomato’s stock jumped over 45 percent this year so far against a 7 percent gain in the equity benchmark Sensex. Whereas on the NSE, the stock price rose by over 8% to its 52-week high of Rs 93.65.

Brokerages Jefferies, Motilal Oswal, and Nuvama recommended a ‘Buy’, giving a fresh impetus to the stock. Lauding the company’s management, they vouched for its credibility and its execution prowess.